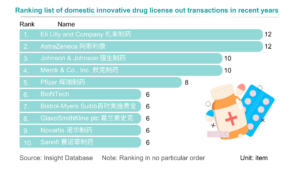

In 2023, marked the start of Chinese innovative drugs expanding globally. Chinese pharmaceutical companies achieved record overseas authorizations, reaching new highs in total transactions, volume, and payments. The first half of 2023 alone saw 17 overseas projects, disclosing a total of $14.3 billion USD, over three times that of the previous year. Amidst intense global pharmaceutical competition, License-out (overseas authorization) becomes crucial for Chinese innovative pharmaceutical companies to succeed internationally. Public data indicates that in 2023, the number of Chinese local pharmaceutical companies licensing out will surpass those licensing in for the first time.

Engine for pharmaceutical market growth in Southeast Asia

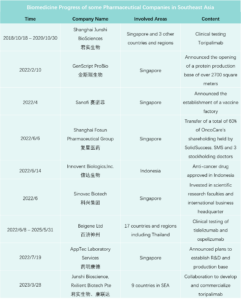

As globalization advances, Southeast Asia, with a population exceeding 600 million, emerges as a key market for the global pharmaceutical industry. SEA hosts numerous pharmaceutical companies, primarily engaged in generic drug production and industrial upgrading. The Chinese pharmaceutical industry’s expertise in technology, R&D, and production complements the substantial demand and growth potential in the SEA market. Integrating Chinese funding and technology, particularly in biopharmaceuticals, can swiftly propel local industry development and generate systemic investment opportunities.

Market Research Institute International predicts an average annual compound growth of 5% – 8% in the pharmaceutical market from 2023 to 2027 in Southeast Asian countries, surpassing the 2.5%-5.5% in developed markets. The Southeast Asian market stands out as having the highest potential for global pharmaceutical development.

While pharmaceutical market demand in Southeast Asia is rapidly expanding, the local industry faces challenges due to limited independent R&D capabilities and a small number of companies. Local pharmaceutical companies in SEA fall into three categories: large multinational corporations, such as Novartis Group; large local enterprises limited to single-country development; and local or foreign manufacturing companies, with limited profitability and weak production technology (excluding biotechnology companies in Singapore).

Southeast Asian pharmaceutical markets have flexible drug regulatory policies and payment systems

As of now, according to incomplete statistics, more than 50 pharmaceutical companies in China are actively developing in the SEA market, and have products on the market or are under development. They are mainly concentrated in the six ASEAN countries with relatively developed economics, of which Singapore, the Philippines, and Indonesia are the most common.

ASEAN countries vary in drug access policies. Some have independent regulatory systems, like Singapore, with efficient processes relying on reference countries’ approvals. In contrast, other countries heavily depend on strict decisions from the US and Europe. Singapore’s rapid 60-day approval process accepts applications based on FDA decisions from reference countries. Additionally, new or innovative drugs can obtain authorization in 180 or 270 days, respectively.

In other ASEAN countries, drug regulatory systems are weak. GCP and GMP inspections and approvals rely on or refer to decisions from other countries.

Difference in Drug Registration among 6 Southeast Asian Countries

International Talent Challenges

Overseas companies encounter varying policies and market conditions, especially in emerging markets with weak information disclosure and regulatory transparency. Cultural differences pose additional challenges for global expansion, making it more complex for companies.

Chinese enterprises undergo a step-by-step process in international ventures. Different stages present distinct challenges, demanding an elevated level of globalization strategy for Chinese pharmaceutical companies. This necessitates implementing strategic talent measures in tandem with global expansion efforts.

- Carrying out corresponding talent strategic deployment according to different stages of globalization. For example, in the product authorization stage, a large number of BD business development talents need to be recruited to negotiate cooperation with multiple parties; in the clinical and research development stage, talents in R&D research and development, registration, clinical operations, CMO, etc. who understand the local market are needed.

- Selection and Training of local talents is also very important. As internationalization deepens, localized operations management needs to be achieved. When selecting and using local talents, companies need to pay attention to: firstly, companies must implement “unified standards” no matter which country the talent comes from, they must treat them equally and give them equal development opportunities; secondly, guide the selection of local talents in accordance with the overall strategy to match the goals of the corporation’s goals in order to achieve best use of human resources; last but not least is to establish a good talent training, allocation and incentive mechanism to better attract talents, retain talents and make good use of talents, etc.

About Comrise

At Comrise, we offer tailored solutions for the full-time, part-time, direct-hire, contract, and permanent talent that your business needs. For 39+ years, we have delighted our clients and candidates by focusing on customer satisfaction, innovation, and flexible workforce solutions!

If you’re looking for new job opportunities click here, or if you’re looking for a reliable partner to help you secure top-notch candidates for hard-to-fill roles, click here.